Manufacturers of Zinc Oxide: How They Differ, and Why the Process Matters

Zinc oxide is a material that seems simple, but its performance depends on things that happen long before the bag or drum gets to your plant. The production method, thermal “French” (indirect), thermal “American” (direct), or wet-chemical (precipitation and related variants), determines the purity, particle size and shape, surface area, coatings, and consistency from batch to batch. These parameters, in turn, affect how rubber compounds, how coatings shine and protect against UV rays, how cosmetics are clear, how bioavailability works in feed, how ceramics sinter, and even how nanoforms are regulated. The quickest way to see why two “99.5% ZnO” powders can act differently is to understand how they work.

The three main industrial routes

1) The French (indirect) process

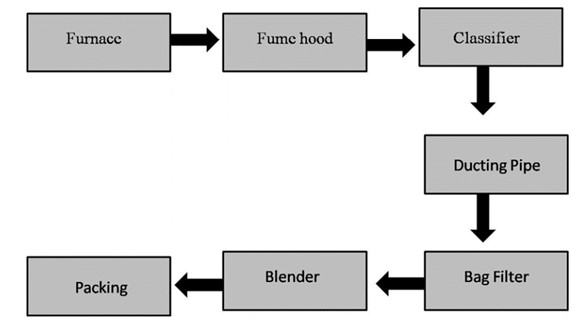

In the French (indirect) process, Special High Grade (≈99.995%) zinc metal is melted and vaporised at about 910–1000 °C. Then, it is oxidised in air to make zinc oxide fume, which is cooled and collected in cyclones and baghouses. Oxidation is “indirect” to the original source because the feedstock is refined metal instead of ore. Modern plants carefully control the combustion, airflow, and cooling to change the size, surface area, and level of impurities in the aggregate. Then, they use steps like deagglomeration or surface treatment to make the aggregate easier to spread. The process makes high-purity ZnO with a tight surface-area control. This ZnO is used in high-end rubber, ceramics, electronics, pharmaceuticals, and cosmetics where cleanliness and consistency are very important.

Zinc turns into a gas just above 907 °C and reacts with oxygen in a controlled way to make ZnO nuclei. These nuclei grow as they cool down. The size and surface area of the particles depend on how long they stay in the water and how quickly they cool down. Handling the powder further refines it. There are different types of commercial grades, such as “white seal,” “gold seal,” and “high-SA” (high surface area). These grades are usually sold with detailed certificates of analysis and specific BET ranges for accurate curing or sintering behavior.

The French process is still the best for high-end products because it makes sure that heavy metals are very low, that surface properties are consistent, and that it works with a wide range of industries. It uses a lot of energy and relies on expensive SHG zinc, which are its main problems. It does give you great control, but getting ultrafine transparent grades often requires extra wet-chemical or specialised fume technologies.

2) The American (direct) process

The American (direct) process makes zinc oxide by heating ores that contain zinc, calcine, or smelter by-products with a carbon-based reducer like coke or anthracite. When zinc compounds are heated, they turn into metal vapor, which quickly turns back into ZnO and is collected as fine fume. The process combines reduction and oxidation in one step because the feedstock comes directly from ores or secondary residues instead of refined zinc metal. It is widely used for tires, rubber goods, agriculture, and ceramics, where ultra-high purity is not necessary. It is also very cost-effective.

When carbon is heated, it turns zinc oxide or sulfide feedstocks into vapor, which then oxidizes when it leaves the furnace. To make the most of by-products and support circular production, plants are often built close to smelters or recyclers. Modern direct-process facilities have made gas cleaning and dust collection better, which makes the products cleaner and more consistent. Some plants also sell “active” ZnO with a larger surface area to make it more reactive in rubber, which brings it closer to the performance of the French process.

The process’s main strengths are that it saves money, lets you use a variety of raw materials, and has the potential to be environmentally friendly. But it is more difficult to get the very low levels of heavy metals and tight tolerances for surface area that are typical of French-process ZnO. Changes in feedstocks can affect uniformity, but newer plants have made consistency and following the rules much better.

3) Wet-chemical (precipitation and related) routes

The first step in making wet-chemical zinc oxide is to dissolve purified zinc salts like sulfates, chlorides, or nitrates in a controlled way. To make a precursor, which is usually basic zinc carbonate or hydroxide, the pH, temperature, and mixing are all changed. The precursor is calcined to make ZnO after it has been aged, washed, filtered, and dried. Manufacturers can control the size, shape, and surface area of particles very precisely because nucleation and growth happen in liquid. This is hard to do with vapor-based methods.

This method enables the production of ultra-fine and nanoscale ZnO grades with shapes that can be tailored, such as rods, plates, or spheres. Hydrothermal or sol-gel variations make uniformity and control even better. These powders are used in cosmetics that block UV rays, clear coatings, catalysts, and advanced ceramics. Silica or alumina is often used to treat the surfaces of cosmetic and personal care products to make them more stable, spread out, and smooth, while also following strict rules for characterizing and testing “nanoform” materials.

The wet-chemical method gives you the most control over particle design, low levels of heavy metals to start with, and an easy way to get functionalized surfaces. However, it takes more resources, like a lot of water, thorough washing to remove leftover ions, and a lot of energy to calcinate. Even though it costs more, it is necessary for high-performance, high-purity, or optical applications where regular fuming won’t work.

What the route determines (and what buyers actually feel)

Even if two products pass the same test, their different manufacturing processes create different microstructures that affect how well they work. French-process zinc oxide is highly pure because it comes from SHG zinc. It has very little Pb, Cd, Fe, and Mn, which is important for pharmaceuticals, cosmetics, and electronics because trace metals can change the way they behave when they are heated and cooled. Direct-process grades depend on the quality of the ore and how well the gas is captured. Modern producers have good control over these grades, but they are usually used in applications where purity is not as important.

French-process fume makes fine sub-micron particles with a surface area that can be changed. Direct grades are usually coarser, but they are getting better through engineering. Wet-chemical methods let you control the size and shape of particles very precisely, making ultrafine, clear, or special shapes. Surface treatments, like fatty-acid coatings for rubber or silica/alumina shells for cosmetics, have a big effect on how well things mix, how reactive they are, and how stable they are.

High-surface-area French grades make rubber vulcanization more efficient at lower phr, which helps with zinc-reduction efforts. Some direct grades, on the other hand, make curing safer and processing easier. Ultrafine or nano-ZnO in coatings and cosmetics provides strong UV protection with little whitening, in line with SCCS/REACH “nanoform” rules. For ceramics and electronics, the French or wet-chemical grades have better sintering behavior because they are better at controlling impurities and surface area. However, well-made direct ZnO is still good for less demanding uses

How manufacturers position themselves

The main differences between global and regional ZnO producers are the range of processes they use, the types of applications they focus on, and their stance on sustainability

Some companies have both direct and indirect lines. For example, they offer high-purity French grades for cosmetics and pharmaceuticals and cost-effective direct grades for ceramics, rubber, and agriculture. French-only companies put a lot of emphasis on purity, strict BET control, and treated variants for consistent use in sensitive areas.

Now, direct-process leaders sell engineered grades for paints, rubber, and agriculture. Wet-chemical specialists, on the other hand, focus on nano or precipitated ZnO for sunscreens, coatings, and catalysts. These products are different because of their particle design and full SCCS/REACH nanoform documentation

Cost, energy, and carbon

Thermal processes use a lot of energy to vaporize and/or reduce, while wet-chemical processes move energy into calcination and upstream solution preparation/filtration. Electrification and heat-recovery projects are spreading across both thermal routes. The zinc industry now publishes carbon-footprint guidance, and more buyers want EPDs (environmental product declarations) or LCA data “cradle-to-gate” for ZnO. Manufacturers with integrated scrap recovery and efficient furnaces can say they have lower specific CO₂ per ton. This is becoming a key factor in tenders, especially in Europe.

Application-driven differences you’ll see on the plant floor

In the making of rubber and tires, finer high-surface-area (HSA) French-process zinc oxide speeds up the curing process and makes the material stronger than coarser direct-process grades. To use less zinc without lowering the quality of the cure, tire makers often choose direct ZnO for bulk carcass compounds and HSA or “active” grades for thin or precise parts. Ultrafine wet-chemical ZnO improves UV protection and transparency in clear coats, while French grades improve whiteness and lower yellowing in topcoats. Direct grades are still the best value for primers and undercoats.

Table 2: Comparison of traditional active ZnO (A-ZnO) with a composite material (M-ZnO) in truck tire tread applications

| ZnO Type | ZnO Content (phr) | Crosslink Density | Tensile Strength (MPa) | Tear Strength (N/mm) | Abrasion Resistance | Rolling Resistance |

| A-ZnO | 2 | Medium | High | High | Good | Higher |

| M-ZnO | 2 | Medium | High | High | Good | Lower |

| A-ZnO | 3 | High | Improved | Improved | Improved | Moderate |

| M-ZnO | 3 | High | Improved | Improved | Improved | Lower |

Nano-scale ZnO in cosmetics offers robust UV-A protection with minimal whitening, although it necessitates comprehensive SCCS and REACH compliance documentation. Many formulators are switching to coated or ZnO–TiO₂ hybrid systems to get around nanoform rules. French and wet-chemical ZnO are better for consistent sintering and microstructural precision in ceramics and electronics because they keep impurity levels stable and control surface area. In agriculture and feed applications, direct-process ZnO is still a good choice because it is easy to disperse, dissolve, and is cost-effective, where trace-metal limits are not as strict.

Quality, compliance, and “nanoform” reality for modern buyers

Two cross-cutting topics now separate mature ZnO suppliers from the pack:

1) Documented quality systems and regulatory files.

You should get full CoAs, change-control policies, and, if necessary, EU REACH registrations that list nanoforms. You should also get cosmetic-grade dossiers that follow the SCCS Notes of Guidance. People who buy cosmetics should check to see if a grade is “nano” or “non-nano,” what the coatings status is, and if the particle metrics match what the label says.

2) Carbon and circularity reporting.

More and more European customers want product carbon footprints (PCFs) and life cycle assessments (LCAs) “cradle-to-gate.” It is easier to compare footprints when there is industry guidance for zinc and downstream ZnO. Producers who use recycled feeds (direct process) or electrified heat can claim advantages. Request alignment with the methodologies (ISO 14040/44, GHG Protocol Product Standard).

Choosing a manufacturer: practical heuristics

If you need the best purity and surface-area control (for example, pharmaceutical excipients, cosmetics with strict heavy-metal limits, or electronic ceramics), make a list of French-process experts who have published SA ladders and treated variants for dispersion. Check trace metals and BET windows in lots.

[1] If you want to get the best performance for the least amount of money in rubber or agriculture, look at modern direct-process grades from companies that also publish impurity profiles and dispersion metrics. Do cure curves at the same phr and at a lower phr to see how much it costs to use, not just $/kg .

If you need very fine or shape-specific powders (like transparent UV coatings, high-SPF sunscreens, or catalysts), look for wet-chemical/nano specialists who offer coating options and complete EU nanoform documentation. Ask for data on the size distributions of the particles by number and volume, the chemistry of the coatings, and the photostability of the powders.

If you care about sustainability data, ask for EPDs or PCFs and find out how the producer takes into account recycled feed, energy mix, and heat recovery. Think about whether your customers or auditors need EU REACH nanoform identification and cosmetic dossiers that follow SCCS guidelines

What’s new since 2023–2025: a brief outlook

Convergence of process portfolios. To provide consistent logistics and technical support across cost and performance bands, more producers market both direct and indirect portfolios, sometimes at the same site.

Ultrafine without “nano”? Research and commercial literature examine composite and coated methodologies to achieve UV performance while minimizing regulatory intricacies; anticipate an increase in “nano-free” UV assertions in cosmetics while ensuring substantial UV-A protection.

Pressure to report on carbon. European tenders and big multinational companies now want ZnO suppliers to provide PCFs that can be checked. Industry guidance has gotten better, and CO₂-per-ton differentiation is going from marketing to a specification line item

Changes in the mix of applications lead to market growth. Tires are still the main volume, but cosmetics, specialty ceramics, and catalysts are the fastest-growing niches where process-specific microstructure gets extra money

Conclusion

- French (indirect) process: high purity, tight control of surface area, and wide acceptance in high-spec applications like rubber when a reactive cure is needed, pharmaceuticals/cosmetics, and electronic ceramics.

- The American (direct) process leads in value, has circular feeds, and makes engineered grades for rubber, agriculture, and paint where standards allow.

- Wet-chemical means ultrafine control, morphology tuning, and the default for transparent UV protection and specialty catalysis. It also means that nanoforms need more documentation.

It’s not so much about the one number on a CoA when you choose a manufacturer as it is about matching the process fingerprint to your application and the rules that apply to it. The best suppliers show their work by showing their route, feedstock strategy, impurity control, surface-area ladder, optional treatments, and the paperwork needed to follow the rules today.

- Kim, I., et al., Effect of nano zinc oxide on the cure characteristics and mechanical properties of the silica-filled natural rubber/butadiene rubber compounds. Journal of Applied Polymer Science, 2010. 117: p. 1535-1543.